Investment Principles

Our investment principles are our DNA, a set of beliefs which form the basis for how we manage our clients’ assets. While our investment principles are long established, we continue to fine-tune their application in order to improve our understanding of markets and the probability of investment success.

- Inefficient Markets – We do not believe markets are efficient

- Invest Opportunistically – Invest below our estimate of intrinsic value

- Business Owners – Invest in businesses rather than buying stocks

- Risk Averse – Preservation of our clients’ capital is key

- Long term – Investing is a marathon, not a sprint

- Contrarian – We are not afraid to swim against the tide

- Consider scenarios – We consider scenarios rather than making forecasts

- Financially strong – Businesses we own must have strong balance sheets

- Humility – We make mistakes and always endeavour to learn from them

- Integrity – We will act with integrity in everything we do

Our Approach

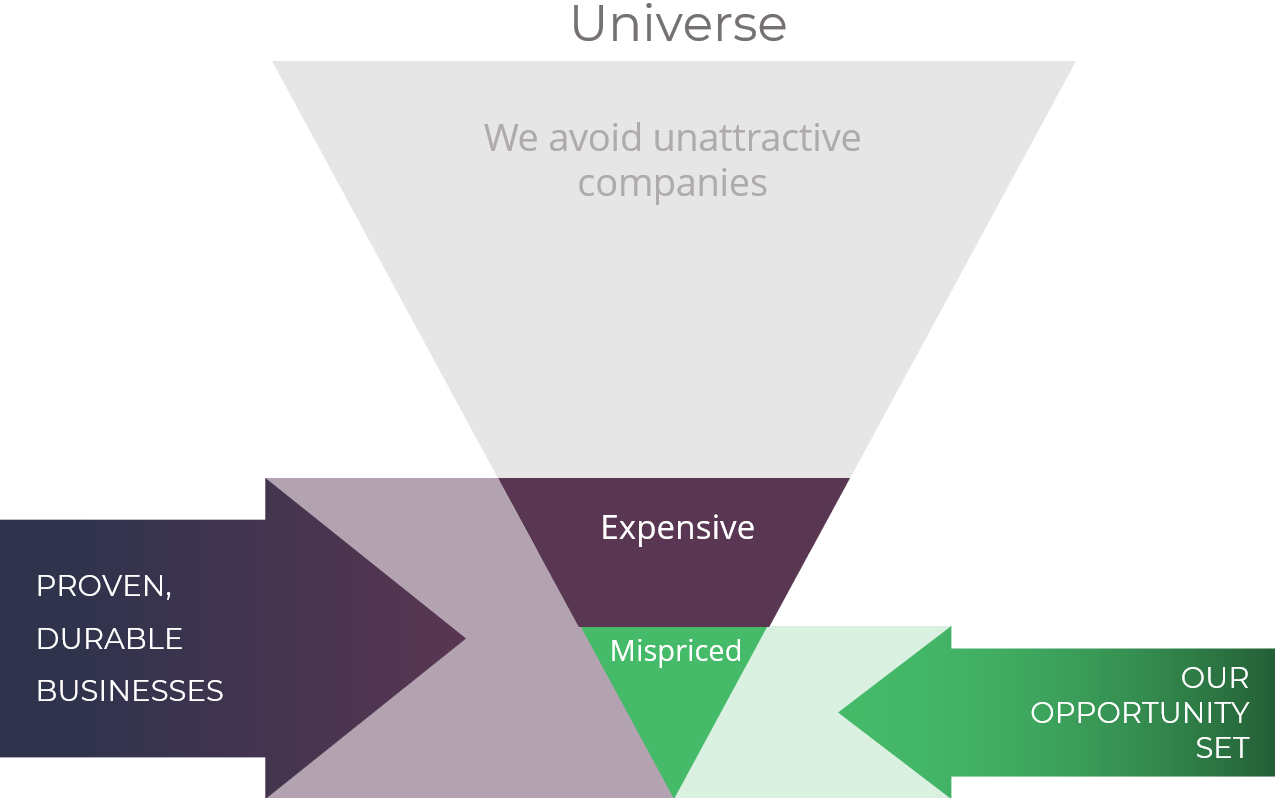

Our funds are concentrated. According to the World Federation of Exchanges there are 45,000 companies quoted on its members’ exchanges; we own less than 150 across all our funds.

We are highly selective and invest based on investment merit rather than size or popularity. We find many thousands of companies do not fit in with our investment principles. We pass on these.

Rather, we look to invest in companies that are understandable, financially sound and well managed – what we call Proven Durable Businesses.

That in itself is not enough. A winning investment formula is investing in these types of businesses when they are mispriced, Our Opportunity Set. Correctly identifying these requires us to have intelligent insights and to be opportunistic and patient.

Research Process

The research effort is our centrepiece. It is a quantitative and qualitative process, with an emphasis on qualitative. Our key aim is to understand not just what sales and profits a company makes, but rather how (and how sustainable). In the absence of this, an attempt to value a company is unanchored – just figures on a page. This is what we mean when we say Value is More than a Number.

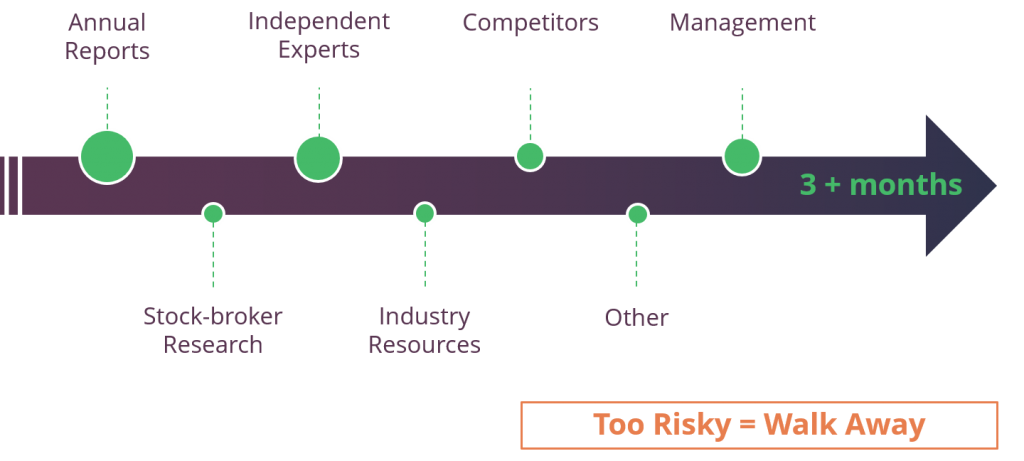

Our research effort is lengthy, thorough and ongoing. It is done in-house, using various sources including some of those shown in the diagram below.

It’s a process that has no finish line. The more we think a company fits our Proven Durable Business profile, the deeper we will dig to try to disprove the thesis. And if we find the business is too risky, we walk away.